Charles Ponzi, a name forever associated with financial fraud, was the mastermind behind the notorious Ponzi scheme. Born in Italy in 1882, Ponzi immigrated to the United States, initially working various jobs before finding his way into the world of finance.

It was there that he devised a scheme exploiting international reply coupons, promising investors incredible returns within a short period. Ponzi’s charisma and the allure of quick wealth drew in a large influx of investments, and his plan was brilliant, initially.

Ultimately though his money-making scheme caused so much trouble that it was banned, and Ponzi became forever associated with financial fraud. But despite 150 years’ warning, the Ponzi Scheme is still an incredibly common form of fraud that is still catching unsuspecting victims unaware.

Charles Ponzi and his Original Scheme

Today Ponzi is famous for being a swindler, the ultimate confidence man. Born on March 3, 1882, in Lugo, Emilia- Romagna in northern Italy, Ponzi was born into a family that had once been rich but had fallen into challenging times. As a young man, his family encouraged him to move to America, become rich, and then return home so he might restore his family to their former glory.

Ponzi arrived in the US in Boston on November 15, 1903, aboard the S.S. Vancouver. Upon his arrival, he quickly learned English and spent his first few years in America working up and down the East Coast.

He worked odd jobs, including dishwasher, waiter, and even sailor. Ominously, he was fired from his job as a waiter after the restaurant owners realized he had been dipping his fingers into the till and short-changing customers.

Eventually, Ponzi found himself in the world of finance, starting as a clerk in a bank and later as a teller. However, it was his keen interest in investments that led him down a path that would forever tarnish his legacy.

Ponzi’s early experiences in the financial industry paved the way for his later scheme, exploiting international reply coupons to promise investors extraordinary returns. Despite his initial ambitions, Charles Ponzi’s name is now indelibly associated with one of the most notorious financial frauds in history.

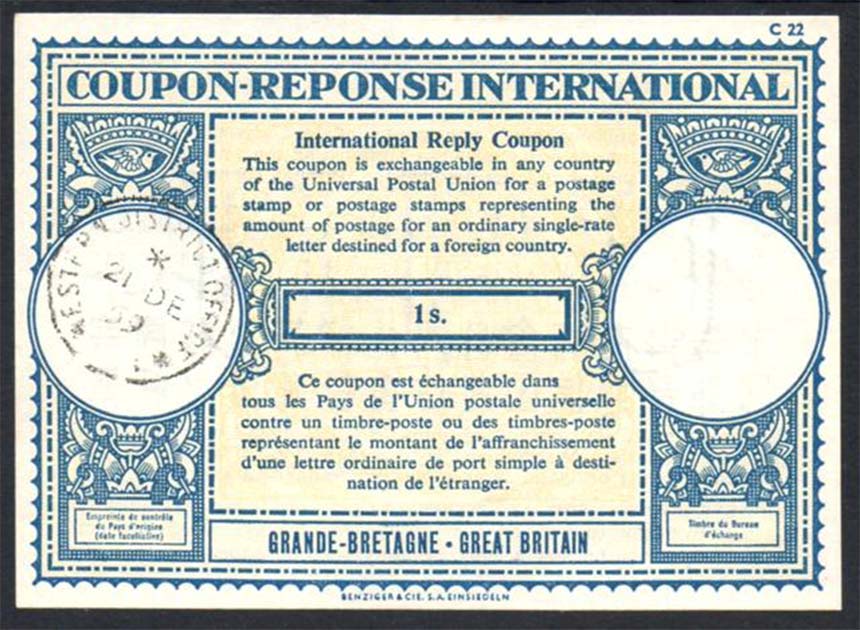

So exactly what was the original Ponzi scheme? Well, it all revolved around exploiting international reply coupons, known as IRCs. These are coupons that can be exchanged for one or more postal stamps that represent minimum postage for airmail.

- The Great Stock Exchange Fraud: Lord Cochrane’s Napoleonic Lies?

- How the Darien Scheme Changed the History of Scotland’s Independence

In the early 1920s Ponzi discovered a loophole in this system. He realized that he could buy these IRCs at a discounted price in one country and then exchange them for stamps that had a higher value in another country.

This is nothing new: arbitrage trading is still common and profitable in the world of finance. The problem was Ponzi needed money to buy the coupons in the first place and so he offered investors incredible returns within a short period by leveraging this arbitrage opportunity.

Ponzi approached potential investors and promised them returns of more than 50% within 90 days. It sounds too good to be true, but Ponzi knew how people think and capitalized on people’s desire for quick wealth and quickly attracted a large influx of investments.

Ponzi soon ran into trouble though. He had overpromised and before long he was using the most recent investors’ funds to pay off his earlier investors, creating an unstable cycle. When investors became nervous, and withdrawals exceeded new investments the whole thing crumbled and collapsed.

While some early investors did make substantial profits, Ponzi’s scheme ultimately unraveled, causing financial ruin for thousands. In 1920, Ponzi was arrested for mail fraud and sentenced to prison. His name became synonymous with fraudulent investment schemes and continues to be a dirty word in the world of finance.

Why are Ponzi Schemes Illegal?

Because they don’t work. Ponzi schemes, also known as pyramid schemes, are illegal for several incredibly good reasons.

Firstly, they operate on a fraudulent premise that deceives investors by promoting unrealistic returns. These claims are a form of securities fraud as they manipulate and misrepresent investment opportunities.

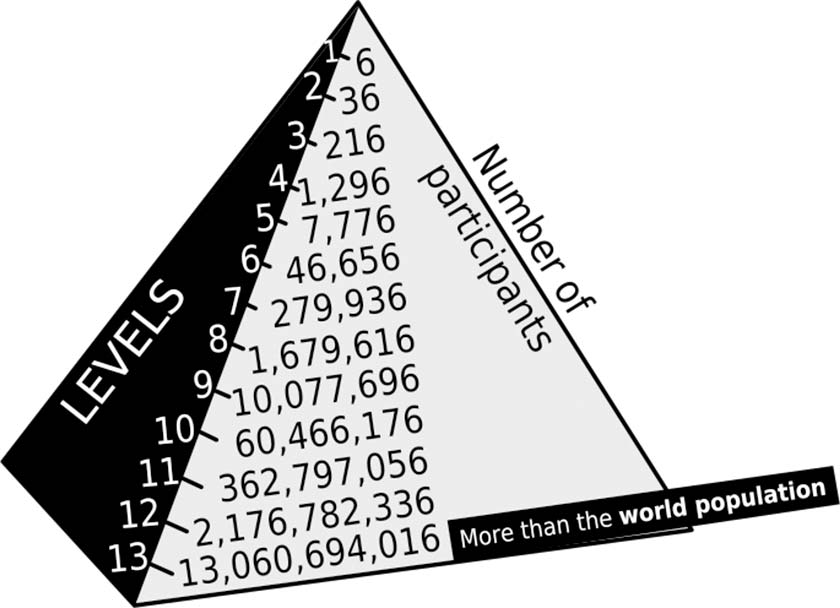

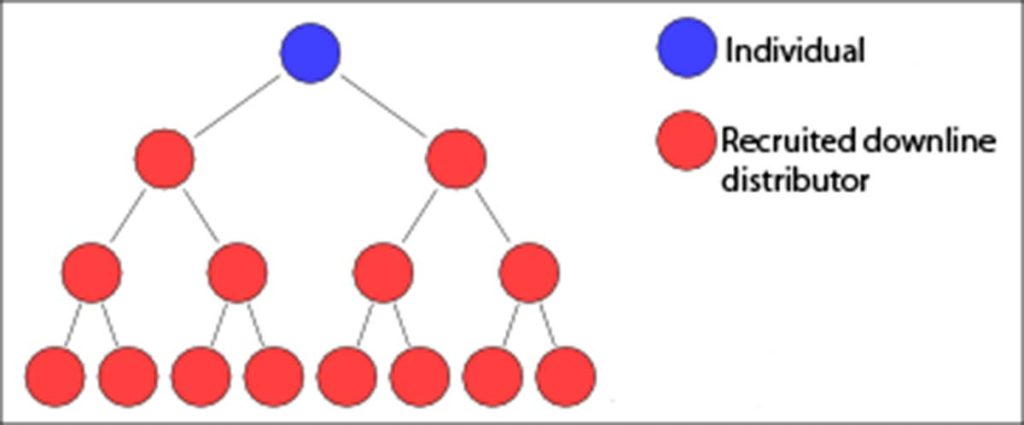

Moreover, Ponzi schemes rely on a continuous influx of new investors to sustain the payouts to earlier investors. This creates a pyramid-like structure that is inherently unsustainable and collapses when there is an insufficient number of new participants.

Secondly, governments have established strict rules and laws that seek to protect investors by ensuring transparency, accountability, and fair practices in the financial markets. Ponzi schemes flout all of these regulations, operating outside of a legal framework and exploiting unsuspecting individuals for the personal gain of a few.

Finally, Ponzi schemes ruin people’s lives. They inflict potentially massive financial harm on the majority of participants, who are often newcomers to the world of investments.

- James Macpherson: The Ossian Fraud

- Michelangelo’s Fakes: Was the Artist A Fraud Before He Was A Master?

Only a small fraction of early investors actually make any profit while the majority lose everything. This not only causes financial devastation for participants but also undermines public trust in the financial system, which can have catastrophic consequences.

As a result of these reasons, governments and regulatory bodies around the world have implemented strict laws and enforcement measures to detect and prevent Ponzi schemes, ensuring investor protection and maintaining the integrity of the financial markets.

Why Are They Still So Popular?

Despite all this, Ponzi schemes are still incredibly popular today. The world of crypto banking and NFTs has given con artists exciting new ways to reinvent the traditional Ponzi scheme. So why are people still falling for it?

The first and most obvious reason is greed. Ponzi schemes promise high returns within remarkably short time periods. These inflated returns draw in novice investors looking for quick returns and easy money. It brings in both affluent individuals who can afford to risk some capital and those who are financially desperate.

The conmen behind Ponzi schemes often also use exclusivity as a selling point. They either target high-net-worth groups of individuals or those within close-knit communities like religious or social groups. This exclusivity creates an illusion of prestige and privilege, making the scheme more alluring to those seeking elite investment opportunities and creates an artificial sense of scarcity. People hate missing out.

Ponzi schemes often utilize word-of-mouth marketing and rely on referrals. Existing investors are incentivized to recruit new investors with the promise of referral bonuses or higher returns. This creates a network effect and contributes to the scheme’s popularity among well-connected individuals.

Finally, never underestimate the power of FOMO. The fear of missing out (FOMO) and the lure of extraordinary returns can cloud judgment and override rational decision-making. The promise of quick wealth can be enticing, leading even experienced investors to overlook red flags and warning signs associated with Ponzi schemes.

A Dangerous Game

Charles Ponzi’s legacy serves as a stark reminder of the devastating consequences that can arise from fraudulent financial schemes. His ability to manipulate investors, coupled with the allure of extraordinary returns, made the Ponzi scheme a popular choice for fraudsters targeting high-end investing.

Ponzi’s actions not only led to financial ruin for countless individuals but also shook public trust in the financial system. Governments and regulatory bodies have since strengthened laws and enforcement measures to prevent such schemes, emphasizing the importance of investor education and due diligence. Sadly, however, new versions of the traditional scheme rear their heads on an almost daily basis.

Once the realm of high-end investing, the popularity of cryptocurrencies has led to the creation of more and more Ponzi schemes that target naive first-time investors looking to make a quick buck. Charles Ponzi’s name continues to be synonymous with deceit and should serve as a cautionary tale for those enticed by get-rich-quick schemes.

Top Image: Mugshot of Charles Ponzi. Source: US Government / Public Domain.